They’re Still Here

Once upon a time, before the advent of limited liability companies (“LLCs”), taxpayers would occasionally acquire real property in a corporation rather than in a limited partnership.

The corporation may have been created to hold the real property, or it may have been an operating company that, for some misguided reason, decided to hold both its operating assets and its real property under the same corporate umbrella.

If the shareholders did not think to make an “S” corporation election for the corporation within the two-and-one-half month period after its creation, the corporation would be treated as a taxable “C” corporation at least until the beginning of its next taxable year. If the corporation was profitable, it would generate earnings and profits (“E&P”), the distribution of which would be taxable to its shareholders.

Despite the shift to the LLC in recent years, many of these real property-holding S corporations are still with us. In many cases, the corporation has sold its operating business, but has retained the real property in order to generate a stream of rental income for its shareholders. Often in these situations, the fair market value of the property has appreciated significantly. In the meantime, the corporation’s basis in the property has been reduced as a result of depreciation.

The shareholders of these corporations would certainly prefer to convert their form of ownership of the property from a corporation to an LLC that would be treated as a partnership for tax purposes. Unfortunately, under the circumstances described above, such a “conversion” would cause the corporation and its shareholders to realize significant gain, as if the corporation had sold the property at its fair market value. If the corporation is still within its so-called “recognition period,” then the gain would be taxable at both the corporate and shareholder levels. Alternatively, if the built-in gain period has expired, the gain from the conversion might be taxed as ordinary income to the shareholders, rather than as capital gain, under certain related party rules.

For these reasons, the S corporation will generally remain in place. However, that is not to say that the corporation can be complacent, at least not if it has E&P.

Passive Receipts

The Code imposes a corporate-level tax on an S corporation for a taxable year if:

- More than 25% of its gross receipts for the year are “passive investment income,” and

- The corporation has accumulated E&P from tax years in which it was a C corporation.

The tax is imposed at the highest corporate tax rate, 35%.

Moreover, the corporation’s “S” election will be terminated whenever the corporation:

- Has accumulated E&P at the close of each of three consecutive taxable years, and

- Has gross receipts for each of such years more than 25% of which are passive investment income.

In light of the foregoing, the shareholders of an S corporation that has accumulated E&P, and that generates rental income from real property, must take action if they hope to avoid the corporate tax and to preserve the corporation’s “S” status.

Pay A Dividend?

There are two elements to consider:

- The presence of E&P, and

- The nature of the rental income.

E&P

If the E&P can be eliminated, the issue will be moot. For example, an S corporation that makes a distribution to its shareholders may elect, with the consent of the shareholders, to treat it as a C corporation dividend to the extent of its accumulated E&P (rather than as a distribution of AAA, first, then as a dividend). In this case, the corporation’s S status will not be effected.

Nature of Rental Income

Similarly, if the rental income is not treated as passive for purposes of the above rules, the tax will not apply and the loss of S corporation status may be avoided. Over the years, the IRS has considered many situations involving the possible characterization of rental income as passive investment income. Most recently, the IRS reviewed a situation involving an S corporation (Corp) that owned, leased and managed certain commercial real estate property (the “Property”).

Is the S Corp Active?

Through its officers, employees and independent contractors, Corp provided certain services with respect to the leasing of the Property. These services included daily janitorial and rubbish removal services, regular maintenance, repairs and inspection covering plumbing, electrical and drainage systems as well as roofing, landscaping and building improvements. The services also included daily security services and management and control of all common areas, including parking lots and picnic table areas. Corp additionally negotiated and executed leases with tenants, settled tenant disputes and collected rents and monthly sales reports, negotiated bank loans and insurance contracts for the Property and performed background checks on prospective tenants.

The IRS stated that the term “passive investment income” means gross receipts derived from royalties, rents, dividends, interest, annuities, and sales or exchanges of stock or securities.

It also noted that IRS regulations provide that “rents” does not include rents derived in the active trade or business of renting property. According to the IRS, rents received by a corporation are derived in an active trade or business of renting property only if, based on all the facts and circumstances, the corporation provides significant services or incurs substantial costs in the rental business. Generally, significant services are not rendered and substantial costs are not incurred in connection with net leases.

Whether significant services are performed or substantial costs are incurred in the rental business is determined based upon all the facts and circumstances including, but not limited to, the number of persons employed to provide the services and the types and amounts of costs and expenses incurred.

Based solely on the description of Corp’s activities, above, the IRS concluded that the rental income that Corp received from its operations was not passive investment income that would trigger the imposition of the tax.

The IRS also added, as an aside, that the S corporation rules considered in the ruling (and described above) are independent of the passive activity rules; unless an exception under those rules applied, the rental activity would remain passive for purposes of those rules notwithstanding the conclusion that they were not passive for purposes of the for S corporation tax.

What’s An S Corp To Do?

What if Corp’s rental activity had been treated as passive under the S corporation rules? What if not all the shareholders consented to elect to an E&P distribution? In those cases, the S corporation must monitor its active and passive receipts. It may have to reduce its receipts from passive investment income, or it may have to increase its receipts from an active trade or business (perhaps by investing in such a business through a partnership), so as not to run afoul of the 25% threshold.

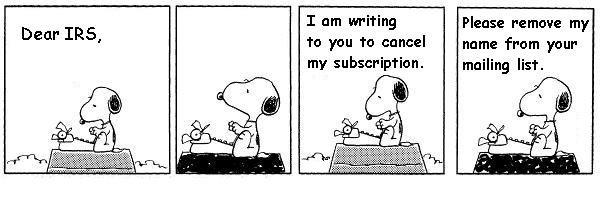

What is certain is that the S corporation and its shareholders cannot simply ignore the issue and hope that it is never discovered.